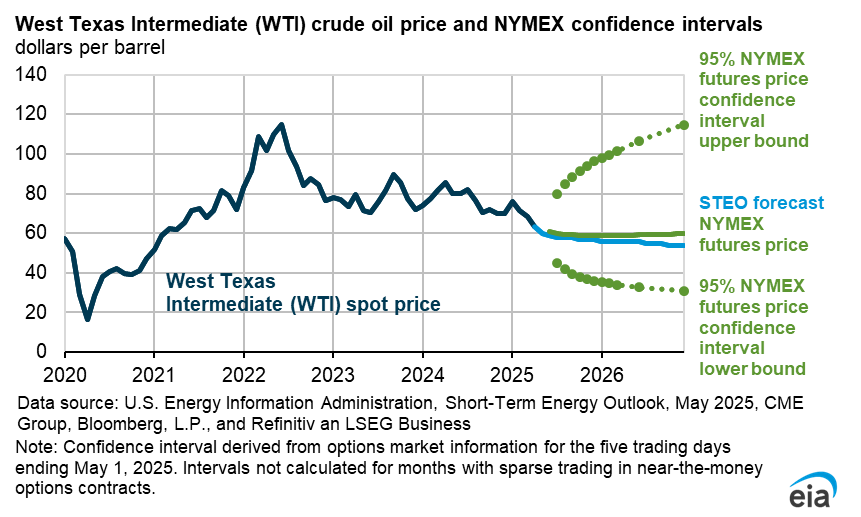

Excerpt: “Trade policy assumptions. The U.S. macroeconomic outlook we use in the Short-Term Energy Outlook (STEO) is based on S&P Global’s macroeconomic model. S&P Global’s most recent model reflects the tariffs announced on April 2, but the model was finalized prior to the 90-day temporary suspension of tariffs granted to certain countries. As a result, our macroeconomic forecast assumes significantly lower tariffs on China’s products than are currently in place and significantly higher tariffs on countries subject to the 90-day temporary suspension. These differences in tariff rates likely have offsetting effects on the macroeconomic forecast. Macroeconomics. Our U.S. GDP forecast has been revised downwards from our April STEO. We now assume real GDP will grow by 1.5% in 2025, a 0.5 percentage point reduction from the April STEO, and 1.6% in 2026, a 0.4 percentage point reduction from last month. Global oil prices. We expect crude oil prices to fall over much of the forecast period. The Brent crude oil spot price averaged $68 per barrel (b) in April. In our forecast, increasing oil production outpaces annual oil demand growth, which rises by around 1.0 million barrels per day (b/d) in both 2025 and 2026, leading to the accumulation of oil inventories globally. We expect the rising inventories will result in the Brent price averaging $62/b in the second half of this year and falling to $59/b next year.”

40,225 Entries

31 Added in Past 24 Hours