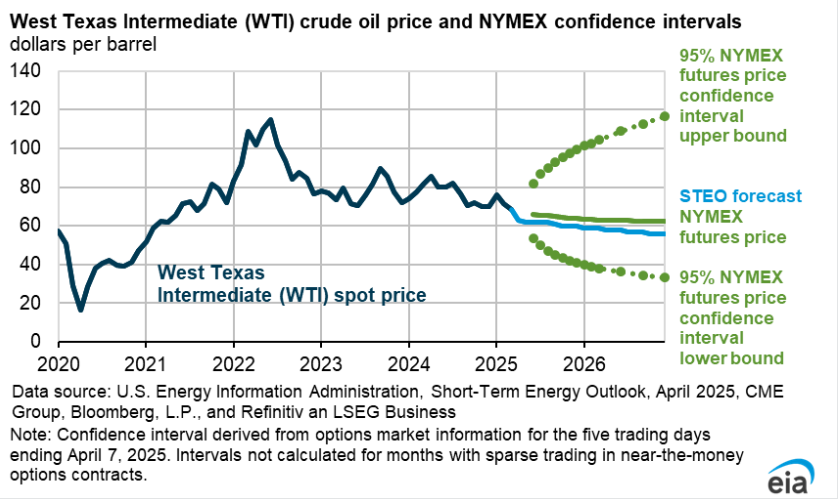

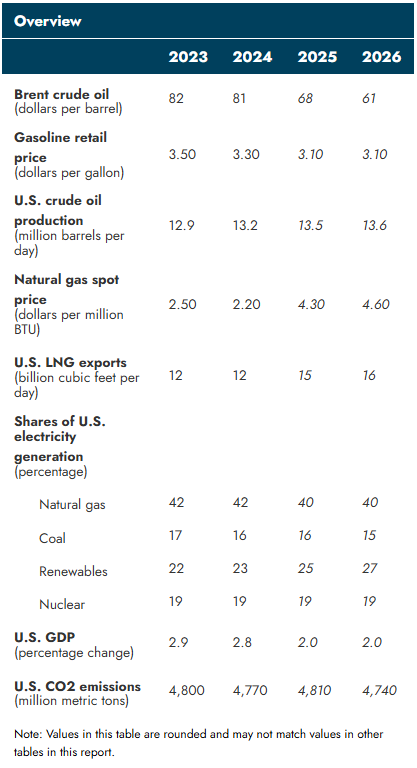

Excerpt: “Global oil demand. We assess that there could be less oil demand growth, and we have reduced our outlook for global oil demand accordingly. We now expect that global oil consumption will increase by 0.9 million barrels per day (b/d) in 2025 and 1.0 million b/d in 2026, 0.4 million b/d and 0.1 million b/d less than what we forecast in last month’s STEO, respectively. However, because the recent updates to trade policy widen the range of possible GDP growth outcomes, this forecast is subject to significant uncertainty. Global oil prices. We expect global oil inventories will increase starting in the middle of 2025 as OPEC+ members unwind production cuts, production grows in non-OPEC countries, and oil demand growth slows. As a result, we forecast the Brent crude oil price will average $68/b in 2025 and fall to an average of $61/b in 2026. Those prices are $6/b and $7/b lower, respectively, than in last month’s STEO and reflect more uncertainty around global oil demand growth as well the potential for additional supply from OPEC+ in the coming months. However, factors including existing sanctions on Russia, Iran, and Venezuela create additional uncertainty for crude oil prices. Gasoline prices. The U.S. retail price for regular grade gasoline averages about $3.10 per gallon (gal) in our forecast for this summer (April–September), about 20 cents/gal less than our forecast in the March STEO. The lower gasoline price forecast mostly reflects our expectation of lower crude oil prices. If realized, our forecast price would be the lowest inflation adjusted summer average price since 2020.”

38,879 Entries

6 Added in Past 24 Hours